Everyone should passively invest at least some money in the stock market. Over time, it is like a savings account on steroids. And who doesn’t want a jacked investment account!?

Passive investing means doing almost nothing…just collect profits. And it turns out, over the last century, this has been a fruitful strategy. Invest capital. That’s it. No selling positions or analysis of where the stock is going to go next. Just invest and hold.

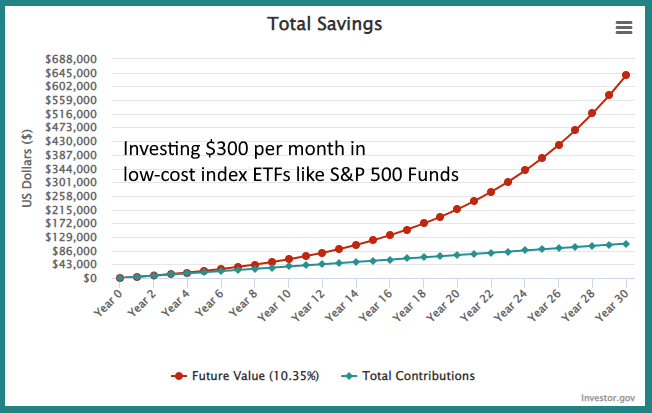

The annualized return for the S&P 500 index, which is a benchmark for how the US stock market performs, is 10.6% per year over the last 100 years.

The Nasdaq 100 index has an annualized return of 14.7% per year over the last 20 years.

In terms of compounding, if we invest and make 10%, the next year we’re making returns on the initial investment plus the profit.

Year after year the account grows (on average) because returns are being made on a larger and larger amount of money.

Investing $300 per month turns into $637K over 30 years…compared to $146K making 1% in a bank account (or about $108K saving if kept under the mattress).

You could of course contribute more or less. And if you can start out with a bigger chunk to invest to get the ball rolling, all the better for the future nest egg.

You can see how different investment amounts, contributions, and average returns (%) compound over time using the Investor.gov compound calculator.

To capture that 10.3% to 10.5% per year, we need to invest in something that mimics the S&P 500. Enter Exchange Traded Funds or ETFs.

Using ETFs to Compound Returns Through Passive Investing

An ETF trades like a stock; it can be bought and sold anytime the stock market is open (930 am to 4 pm EST). You can place an order to buy at any time of day, but the order will execute during the above hours.

The ETF tracks an index, such as the S&P 500, which has a long history of (near 10%/year) upward growth.

Making an annualized return of 10.5% per year doesn’t mean your account goes up 10% a year, every year. Some years the ETFs fall by 30%, other years they go up by 50%, and many years are up or down 5% to 10%. All these fluctuations combine to offer a 10%ish return per year over the long run. You can see all the yearly returns, and long-term charts, in the S&P 500 Average Return article.

Essentially, the longer the time horizon the better. Because the market doesn’t go up every year, we want to be invested for the long term because over brief time periods (even several years) we could lose money. But over the long term, the indices have tended to rise (unfortunately we can’t know for sure what they will do in the future).

Why is there such a long track record of the S&P 500 (and prior indices) increasing? The index is actually a strategy. The index only includes the top 500 companies in the US based on defined metrics. If a company stops performing as well, it is dropped from the index and a better company is added. The index is the top companies in the US in any given year. Good companies tend to grow and increase profits, which increases the share prices. The index is doing the work for you, only tracking the top companies and avoiding the rubbish.

- To get started, I like the Vanguard S&P 500 ETF (VOO) if you’re in the USA.

- Canadians, wanting to invest in the S&P500 with Canadian dollars, I like the BMO S&P 500 Index ETF CAD (TSX:ZSP)

There are thousands of ETFs, and they’re not all equal. Some don’t track the index well, and others have high fees that erode profits. My Passive Investing eBook lays out which other ETFs to buy for Americans and Canadians, how to allocate funds to them, and how to research ETFs yourself.

Real quick though, I put a chunk of my capital in an S&P 500 ETF, a chunk in a technology ETF, and then smaller chunks in cryptocurrency ETFs, and international ETFs (tracking India and Canada, for example, and possibly some others).

When To Passively Investing and Buy

Purchase an ETF at regular intervals, such as monthly or quarterly. Just buy, don’t try to “time” an ideal purchase.

For passive investing, get the money working as quickly as possible, which is when that money is available to invest.

If you pay commissions on each transaction, save up your capital so that the commission is a tiny fraction of your purchase price.

Many brokers in the US are commission-free, and many brokers offer commission-free ETF trading.

National Bank Financial and Interactive Brokers are free and cheap (respectively) brokers in Canada.

Consider whether you want to invest in a tax-protected account (tax advantage now, or don’t pay taxes on gains) or a normal trading account (taxed on gains).

Start Now! Any additional Years Can Mean Big Compounding Returns

If you do nothing else for your future, start passively investing at least a bit of capital each year. Don’t concern yourself with the ups and downs in the stock market, just stick to the plan of regularly contributing.

If you have kids, start them early.

Every $300 investment now is almost $6000 in 30 years.

Guess how much one (no additional contributions) $300 dollar investment is in 60 years? More than $115,000! It pays to start as early as possible. That’s right: one $300 investment making 10.5% per year, turns into $119K in 60 years.

The stock market does have ups and downs, but over 10, 20, or 30+ years, it is definitely worth doing. My only regret is not starting sooner.

I’m a trader, and I initially turned my nose up at making 10% per year. I make higher returns day trading and swing trading…but then I just spent the profits.

I wish I would have passively invested some of my income/profits in my teens and 20s. I didn’t start passively investing till my 30s. Better late than never. Early on I failed to realize that passive investing takes very little work, and the returns can get very big the longer the money is invested.

Investing for 10 years is better than 5. Investing for 20 years is better than 10. You get the point.

The chart above shows that investing $300 per month turns into $637K in 30 years. But if you start earlier, over 40 years you have almost $1.8 million. Any extra years make a big difference! $1.8 million for basically doing nothing, except saving a bit each month (and investing it) which we all should be doing anyway.

Start early. Invest regularly.

If you want more guidance on this, I laid it all out in a quick read Passive Investing ebook so you can start investing and start compounding your money today.

By Cory Mitchell, CMT

Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell anything. Trading is risky and can result in substantial losses, even more than deposited if using leverage.

2 Comments

Leave your reply.